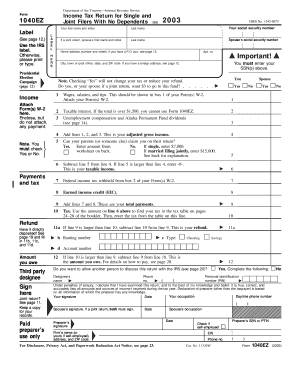

Step 3: Specify all your incomes (wages, unemployment compensation, taxable interest). Step 2: Fill out general personal information (First and Last name, address, and so on). Click on the folders below to find forms and instructions. Step 1: To open the printable 1040 EZ form, you would need to click the Fill Out Form button. You May Mail a Paper Return Directions to print forms:ġ. There are three ways to file: (1) using our website, at no cost, (2) purchasing software to prepare your taxes or (3) using a tax professional to file electronically. The Department encourages all taxpayers to file electronically it’s fast and secure. For more information see our Forms & Publicationspage or the forms and instructions provided in the Browse or Search Forms section below. You couldn’t itemize your deductions on form 1040-A, but you could only claim a limited number of tax credits, including the child tax credit, education credits, earned income credit, credit for child and dependent care expenses, credit for the elderly or the disabled and the American Opportunity Credit.Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return.ĭepending upon your residency status and your own personal situation, you may need other forms and schedules. Unlike on form 1040EZ, you could use form 1040-A to claim certain “above the line” adjustments, including educators expenses, IRA deductions, student loan interest deductions, and tuition and fees deductions (above-the-line deductions are those you can claim even if you don’t itemize your deductions).

You used to be able to file a form 1040-A if your taxable income from the same kinds of income as you’d claim on form 1040EZ plus interest and dividends, capital gain distributions, IRA distributions, distributions from pensions and annuities, and taxable Social Security and Railroad Retirement Benefits was less than $100,000.

The old form 1040-A was a compromise between the form 1040 and the form 1040EZ.

0 kommentar(er)

0 kommentar(er)